Akaysha Energy secures largest BESS financing globally at A$650 million, together with innovative virtual toll offtake with EnergyAustralia

The facility has a tenor of three years and will be used to fund the construction of Akaysha’s latest project, Orana, which is located near Wellington, NSW within the Central West Orana Renewable Energy Zone (REZ). The financing also provides more than A$75m of Letters of Credit to support the project security obligations. Andrew Wegman, Managing Director and Chief Financial Officer at Akaysha announces this financing following an earlier announcement in April this year of a A$250m BESS portfolio debt financing. With Orana moving into construction, Akaysha now has over 4GWh of energy storage projects under construction in Australia.

“We are very pleased to announce the successful closing of the debt financing of the Orana project as we move into construction on Akaysha’s first four-hour BESS to date. As the largest standalone BESS financing globally, this achievement not only secures the capital for Orana’s construction but also highlights the strong support we have received from both local and international banks, as well as from BlackRock. Their commitment to advancing the energy transition in Australia and internationally has been pivotal to reaching this milestone.

This milestone is a significant accomplishment for Akaysha and an important step for Australia’s energy transition. With this latest round, Akaysha and BlackRock have committed and mobilised a total of A$3 billion of capital into the energy transition. This represents an important step in our mission to drive the global shift to sustainable energy solutions while bolstering energy security and grid stability”

Central to the debt financing is an innovative twelve year ‘virtual toll’ offtake agreement secured with leading generator and retailer, EnergyAustralia for 200MW of contracted capacity. This is the first of its kind for EnergyAustralia and, as a financial product, will allow it to “notionally” charge and discharge 200MW of a ‘virtual battery’ within pre-agreed daily bidding parameters, separate from the physical operation of the battery by Akaysha.

Paul Curnow, Managing Director and Chief Commercial Officer at Akaysha says the virtual toll with EnergyAustralia is the largest virtual toll contracted in the NEM to date, and more significantly, on a non-recourse lending basis, and cements Akaysha as a market-leader in the over-the-counter (OTC) battery offtake market, bringing its portfolio-wide contracted capacity in the NEM to 1GW/2.4GWh.

“This ground-breaking and flexible offtake allows EnergyAustralia to virtually “charge” and “discharge” the 200MW ‘virtual battery’ to manage its price and load commitments to its customers, particularly during high demand periods. This type of offtake product can be scaled in contracted capacity to better accommodate Offtaker demand and was devised by Akaysha’s commercial and energy markets teams to allow offtakers to have the full benefits of a large-scale battery asset, whilst not actually having to build and operate one on their own balance sheet - Akaysha will do this for them.”

EnergyAustralia says the offtake agreement aligns strategically with the Australian customer in mind and ensures the delivery of its energy is both secure and reliable. Ross Edwards, Trading & Transition Executive at EnergyAustralia is excited to announce the energy company's innovative offtake agreement with Akaysha,

“We are committed to an orderly and responsible energy transition, and we are actively investing in flexible capacity to enable secure, affordable and reliable electricity for our customers.”

“The virtual toll solution, tailored by Akaysha, fits perfectly within our portfolio. Our clear intention is to accelerate the development of renewable projects and help bring forward the investment needed to support Australia’s clean energy transition.”

Nick Carter, Akaysha's CEO and Managing Director says the Orana project, innovative offtake solution and debt financing is an incredible example to the battery storage market not only in Australia but also globally. It shows what can be achieved not only with innovative and complex contracted offtake, but also how to finance these large Mega scale systems which are requiring exponentially larger amounts of capital. This project, with all its various elements, is a real lighthouse project for the market.

“This announcement represents a significant achievement for Akaysha and marks a crucial step in our mission to rapidly deploy mega-scale BESS, enhancing grid stability and energy security while driving Australia’s shift to sustainable energy solutions. This project will significantly bolster the delivery of a stable supply of energy to the broader Australian community and adds to over 4GWh of energy storage projects under construction for Akaysha. I am very proud of the Akaysha team and our project partners who have helped close this deal. Akaysha is now looking forward to the construction phase and moving rapidly towards COD.”

BlackRock, via its Climate Infrastructure franchise, acquired Akaysha in August 2022. Charlie Reid, APAC co-Head of Climate Infrastructure, BlackRock, says,

“We’re pleased to see Akaysha successfully secure another round of financing to accelerate the development of Orana, contributing to a total of A$3 billion invested across all its energy storage projects. This type of financing serves the urgent need for large-scale batteries to support an orderly, energy transition in Australia. Akaysha’s scale allows it to not only deliver stable energy to the Australian community, particularly during periods of grid and energy instability, but also creates opportunities to export its renewable energy and technological expertise globally as other nations navigate similar challenges in volatile energy markets.”

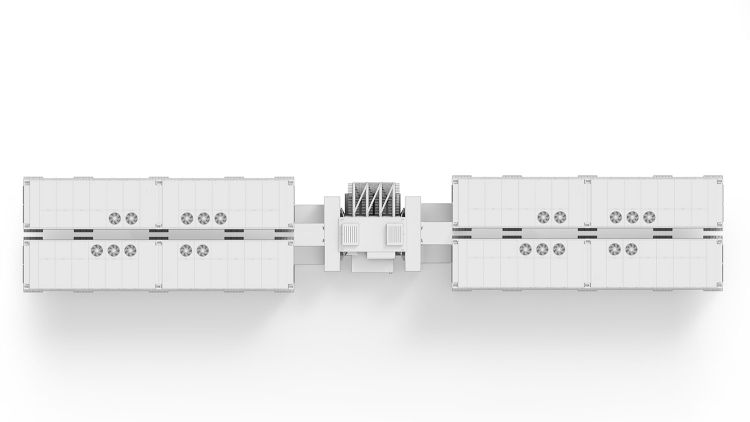

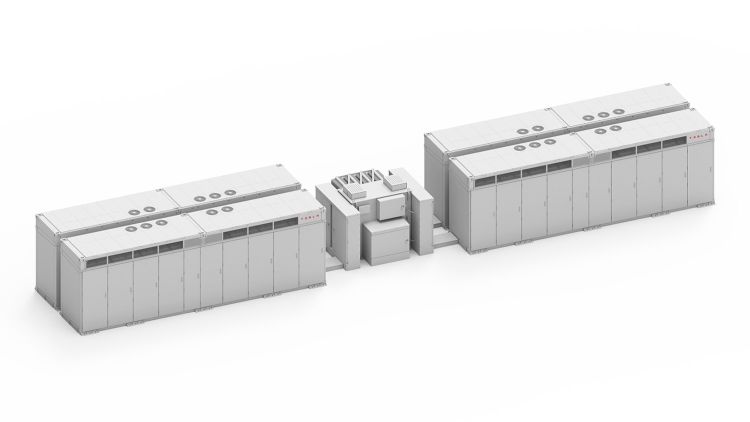

Akaysha’s Orana BESS is being developed within the Central West ‘Orana Renewable Energy Zone’, adjacent to the TransGrid substation near Wellington, NSW. Early works have begun on the project, which will feature Tesla Megapack technology and Balance of Plant (BoP) will be delivered by Consolidated Power Projects Australia Pty Ltd (CPP). The project will provide energy arbitrage and grid firming capability to support the NEM and its rapid expansion of solar and wind projects leveraging existing transmission infrastructure in the region. The Orana BESS is expected to commence commercial operations in 2026.

Akaysha was advised on the financing by Azure Capital and Allens as borrower’s counsel, with KWM acting as lenders' counsel. Ashurst acted as project counsel on the virtual toll. Transaction due diligence advisors were Ashurst, Aurora, DNV, KPMG, JPA and Marsh.